Password Generator

Complete Password Generator and security management suite

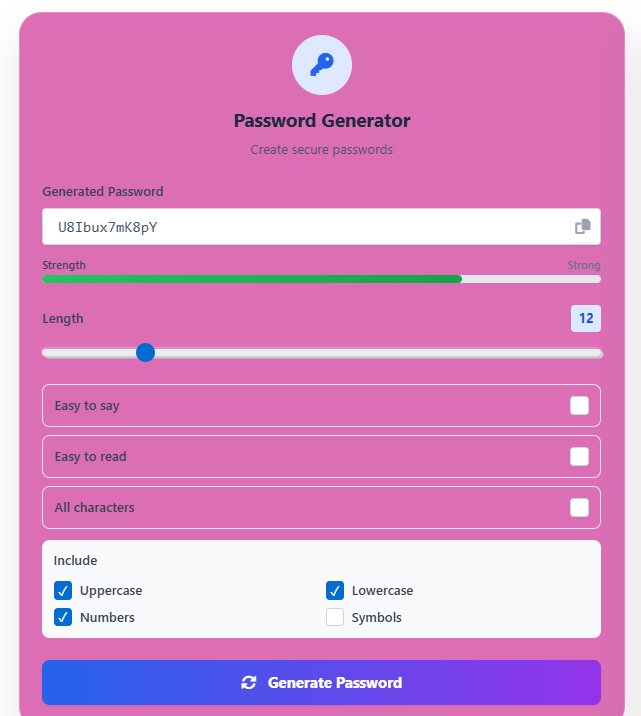

Password Generator

Create secure passwords

Include

Password Checker

Test password strength

Security Metrics

Suggestions

Breach Checker

Check for data breaches

Privacy Notice

We use secure APIs to check breach data. Your email is never stored or logged.

Security Tips

Best practices for password security

Use Unique Passwords

Never reuse passwords across different accounts. Each account should have its own unique, strong password.

Enable 2FA

Two-factor authentication adds an extra layer of security to your accounts beyond just passwords.

Regular Updates

Change passwords regularly, especially for critical accounts like banking and email.

Use Password Manager

Password managers help you generate, store, and manage strong passwords securely.

How to Use a Password Generator for Ultimate Security

A Password Generator creates strong, random passwords that are, as a result, nearly impossible for hackers to guess. Using one is a simple yet powerful step to protect your online accounts; therefore, follow these easy steps to become a security pro.

First, find a reliable Password Generator tool, for instance, by doing a quick online search. Next, look for a tool from a reputable cybersecurity company, and then navigate to the tool once you find a website. After that, you will typically see a box or a button labeled “Generate Password.”

Following this, customize your password’s strength, since most tools offer settings to adjust the length and character types. Consequently, this mix of characters creates a complex and unique password. For example, a strong password looks like a random string, such as X7$kzQ2!pL9@bM1&.

Now, click the “Generate” button, and the tool will instantly create a new, robust password for you, However, do not use common phrases or personal information; instead, let the Password Generator do the work for you. Finally, your last step is to immediately use this new password for your online account.

By actively using this tool, you take control of your digital safety, In other words, you move from weak, reused passwords to a fortress of unique codes.

Furthermore, if you are worried about your data privacy, use our Email Breach Checker to instantly discover if your email has been compromised in past security incidents.

Essential Tips for Using Your Password Generator

Frequently Asked Questions

1. How does an EMI calculator work for loan planning?

An EMI calculator primarily uses three key inputs: specifically, your loan amount, interest rate, and loan tenure. Then, it instantly calculates your monthly payments through a standardized formula. Consequently, this helps you budget effectively and, therefore, allows for smarter financial planning before you commit to any loan.

2. Why should I use a home loan EMI calculator before borrowing?

Firstly, using a home loan EMI calculator allows you to assess affordability comfortably from the very start. Additionally, it helps you compare different loan offers side-by-side in a clear manner. Therefore, you can make truly informed decisions and, as a result, avoid potential financial strain later on.

3. Can this calculator account for floating interest rates?

While an EMI calculator provides accurate estimates for fixed-rate loans, it may not fully predict future fluctuations in floating rates. However, you can still use it very effectively to simulate different possible scenarios simply by adjusting the interest rate input periodically. For instance, you can model best-case and worst-case rate changes.

4. Is this online tool free to use?

Yes, absolutely! In fact, Tooltura’s EMI calculator is completely free and, additionally, requires no registration at all. Moreover, you can use it an unlimited number of times and, therefore, compare various loan structures very conveniently.

FAQs

1. What information do I need to use a car loan calculator?

You primarily need three essential details: firstly, the loan principal amount; secondly, the annual interest rate; and finally, the repayment tenure in months or years, Fortunately, most calculators auto-suggest current interest rates, and this feature ensures greater accuracy for your calculations.

2. Can I use this for personal loan prepayment planning?

Definitely! Specifically, you can easily adjust the principal amount to see precisely how partial prepayments reduce your subsequent EMI or, alternatively, shorten your overall tenure. As a result, this powerful feature helps you strategize debt reduction much more efficiently and effectively.

3. Why does my actual EMI differ slightly from the calculator’s result?

Sometimes, lenders include certain additional charges such as processing fees or insurance costs in the final loan amount. Therefore, while the calculator gives a highly accurate estimate for the principal and interest, you must always confirm the final figures with your bank for complete precision.

4. How does loan tenure affect my EMI amount?

Generally, a longer tenure significantly reduces your monthly EMI amount, making it seem more affordable initially. However, it simultaneously increases the total interest paid over the entire life of the loan. Thus, you must carefully balance short-term affordability with the long-term overall cost.