EMI Calculator

Plan your loan payments with our advanced EMI Calculator

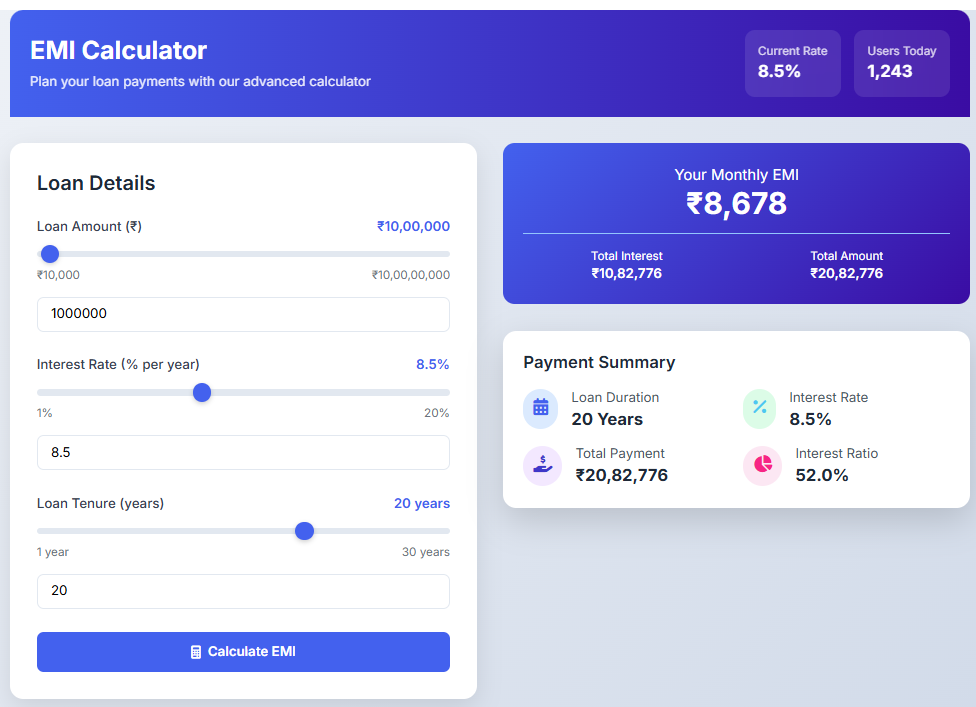

Loan Details

₹8,615

Payment Summary

Yearly Breakdown – Principal vs Interest

What Exactly is an EMI Calculator Tool?

Imagine saving for a new bicycle or video game console. Sometimes, we need help buying big items. That’s where an EMI Calculator Tool becomes your financial superhero! Essentially, EMI means Equated Monthly Installment. It represents the fixed amount you pay monthly when borrowing money. Thankfully, you don’t need math superpowers to use it. With our user-friendly Calculator, you can master money planning in seconds!

Why This EMI Calculator Matters for Your Wallet

First, smart planning prevents money troubles. For instance, borrowing too much might make monthly payments unaffordable. Therefore, using an calculator helps you peek into the future. You can check potential payments before borrowing. Consequently, you can choose options that perfectly match your budget.

Gain Financial Superpowers

Additionally, our calculator gives you control over decisions. Instead of guessing numbers, you get accurate results immediately. Moreover, it allows you to compare different loan choices. For example, you’ll discover how longer repayment periods reduce monthly payments but increase total interest costs.

How to Use Our Simple EMI Calculator in Minutes

Using our EMI Calculator Tool is simpler than learning a new game, Absolutely no advanced math skills are needed. Here’s how it works in three easy steps:

Follow These Simple Steps

Begin by visiting the Tooltura website on any device, Next, enter the loan amount, interest rate, and repayment timeline, Finally, click the “Calculate” button to see magic happen!

Instantly, our tool handles all complex calculations for you, Then, it displays your exact monthly payment amount, Ultimately, the process proves incredibly simple and efficient!

Start Your Journey to Money Mastery

Understanding money management represents a crucial life skill, So, why not begin learning today, By using our free EMI Calculator Tool, you take charge of your financial future. Thus, you can make informed decisions while avoiding surprises, Ultimately, financial awareness leads to less stress and more enjoyment!

Ready to become a budget expert? Visit Tooltura’s website now to try our calculator. You’ll immediately feel empowered to make brilliant financial choices!

For a retirement planning article: “The first step to a secure retirement is understanding your growth potential; our Compound Interest Calculator makes this easy.”

Frequently Asked Questions EMI Calculator

1. How does an EMI calculator work for loan planning?

An EMI calculator primarily uses three key inputs: specifically, your loan amount, interest rate, and loan tenure. Then, it instantly calculates your monthly payments through a standardized formula. Consequently, this helps you budget effectively before committing to any loan.

2. Why should I use a home loan EMI calculator before borrowing?

Firstly, using a home loan EMI calculator allows you to assess affordability comfortably. Additionally, it helps you compare different loan offers side-by-side. Therefore, you can make informed decisions while avoiding financial strain later.

3. Can this calculator account for floating interest rates?

While an EMI calculator provides accurate estimates for fixed-rate loans, it may not fully predict fluctuations in floating rates. However, you can still use it to simulate different scenarios by adjusting the interest rate input periodically.

4. Is an online this free to use?

Yes, absolutely! In fact, Tooltura’s EMI calculator is completely free and requires no registration. Moreover, you can use it unlimited times to compare various loan structures conveniently.

FAQs

1. What information do I need to use a car loan calculator?

You need three essential details: firstly, the loan principal amount; secondly, the annual interest rate; and finally, the repayment tenure. Fortunately, most calculators auto-suggest current interest rates for accuracy.

2. Can I use this for personal loan prepayment planning?

Definitely! Specifically, you can adjust the principal amount to see how partial prepayments reduce your EMI or tenure. As a result, this helps you strategize debt reduction efficiently.

3. Why does my actual EMI differ slightly from the calculator’s result?

Sometimes, lenders include processing fees or insurance costs in the final amount. Therefore, while the calculator gives a highly accurate estimate, always confirm the final figures with your bank for precision.

4. How does loan tenure affect my EMI amount?

Generally, a longer tenure significantly reduces your monthly EMI amount. However, it simultaneously increases the total interest paid over time. Thus, you must balance affordability with overall cost.