FD Calculator

Plan your financial future with our easy-to-use

FD calculator tool

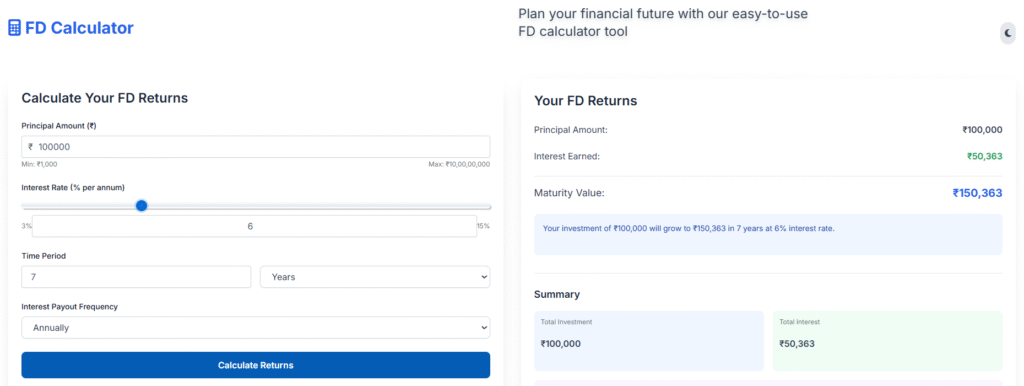

Calculate Your FD Returns

Your FD Returns

Enter details to calculate your FD returns

Frequently Asked Questions

What is a Fixed Deposit (FD)?

A Fixed Deposit is a financial instrument provided by banks or NBFCs which provides investors a higher rate of interest than a regular savings account, until the given maturity date.

How is FD interest calculated?

FD interest is calculated using the formula: A = P(1 + r/n)^(nt), where A is maturity amount, P is principal, r is annual interest rate, n is compounding frequency, and t is tenure in years.

Are FD returns taxable?

Yes, interest earned from FDs is taxable as per your income tax slab. TDS is deducted if interest income exceeds ₹40,000 (₹50,000 for senior citizens) in a financial year.

Can I withdraw my FD early?

Yes, but it may involve a penalty charge of 0.5-1% on the interest rate. The terms vary between banks, so it’s best to check with your provider.

What is an FD Calculator Tool.

Have you ever received money for your birthday and wondered how to make it grow? Well, banks offer something called Fixed Deposits (FDs) that help your money increase over time. However, figuring out how much you’ll earn can be confusing. This is where our fantastic FD Calculator Tool becomes your secret weapon! Basically, it’s a special online helper that shows exactly how much your money will grow in a fixed deposit. Fortunately, you don’t need to be a math expert to use it. With our simple FD Calculator Tool, you can become a savings superstar in minutes!

Why This FD Calculator is Your Savings Best Friend.

First, planning helps you make smart money choices. For example, if you know how much you’ll earn, you can set better savings goals. Therefore, using an FD Calculator Tool gives you super clear vision into your financial future. You can check your potential earnings before even going to the bank. Consequently, you can choose the perfect deposit amount and duration for your needs.

How Calculator Helps You Win

Additionally, our calculator puts you in control of your savings journey. Instead of guessing numbers, you get accurate results instantly. Moreover, it lets you compare different deposit options. For instance, you can see how longer deposit periods often yield higher returns through compound interest magic.

How to Use Our Super Simple FD Calculator.

Using our FD Calculator Tool is easier than learning a new video game! You absolutely don’t need any special math skills. Here’s how it works in three easy steps:

Follow These Simple Steps

Begin by visiting the Tooltura website on any device. Next, enter your deposit amount, interest rate, and savings timeline. Finally, click the “Calculate” button to see instant results!

Immediately, our tool handles all the complicated mathematics for you. Then, it displays your potential earnings clearly. Ultimately, the process proves completely straightforward and efficient!

Frequently Asked Questions of FD calculator

1. How does this work for fixed deposits?

An FD calculator primarily uses three key inputs: your deposit amount, the annual interest rate, and the investment tenure. Subsequently, it automatically computes both your maturity amount and total interest earnings, thereby helping you visualize your returns before investing.

2. Why should I use a fixed deposit calculator before investing?

Using an FD calculator initially helps you compare different interest rates and tenures easily. Moreover, it enables you to plan your finances effectively by providing precise maturity values, ultimately supporting smarter investment decisions.

3. Can tool accurately predict my fixed deposit returns?

Yes, an FD calculator generally provides highly accurate estimates because fixed deposits offer predetermined interest rates. However, remember that the actual returns may slightly vary if the bank revises its rates before you invest.

4. Is there a free online FD calculator available?

Absolutely! Fortunately, Tooltura offers a user-friendly online FD calculator that is completely free and requires no registration. Additionally, you can use it multiple times to evaluate various deposit scenarios instantly.

FAQs

1. How does compounding frequency affect FD calculations?

Compounding frequency significantly impacts your final returns. For example, quarterly compounding typically yields higher returns than annual compounding for the same interest rate, since interest is reinvested more frequently.

2. What details do I need to use a fixed deposit interest calculator?

You only need three simple details: firstly, your deposit amount; secondly, the tenure of investment; and finally, the applicable interest rate. Most calculators conveniently pre-fill current bank rates for reference.

3. Can I use an FD calculator for senior citizen fixed deposits?

Certainly! Specifically, senior citizen FD schemes offer higher interest rates. Therefore, you can easily adjust the interest rate in the calculator to see the extra benefits available for senior investors.

8. How does an calculator help with financial planning?

An FD calculator effectively demonstrates how your money can grow safely over time. Consequently, it becomes an essential tool for planning short-term goals or building a low-risk retirement corpus securely.

“Tracking your wellness journey? Use our BMI Calculator to monitor your progress and understand your body mass index in seconds.”