Simple Interest Calculator

Calculate interest earned or paid on a principal amount over time using Simple Interest Calculator

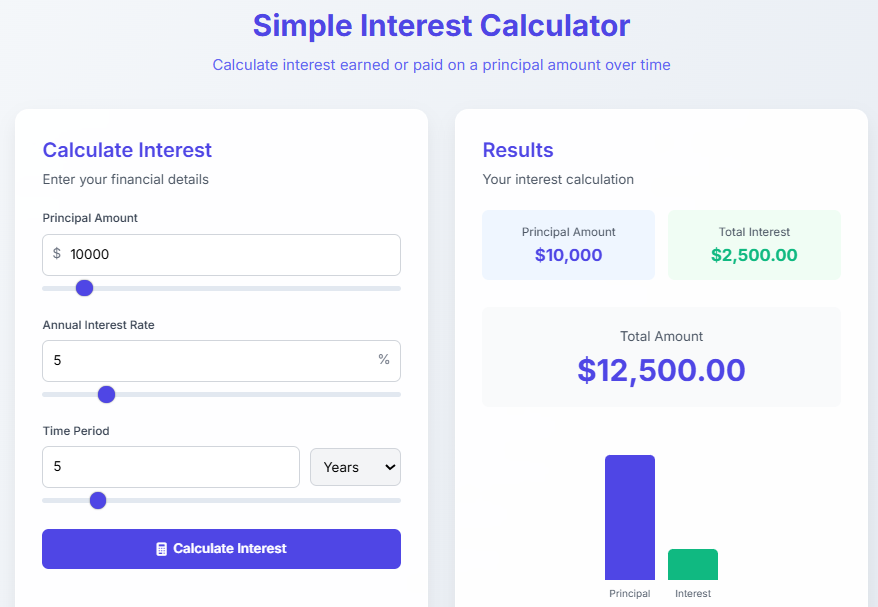

Calculate Interest

Enter your financial details

Results

Your interest calculation

Principal Amount

$10,000

Total Interest

$2,500

Total Amount

$12,500

Principal

Interest

Simple Interest Formula

I = P × R × T

- I = Interest

- P = Principal amount

- R = Annual interest rate (as a decimal)

- T = Time period in years

Simple Interest Calculator: Your Key to Understanding Interest Basics

Have you ever wondered how much extra money you pay on a loan or earn in a savings account? The answer often involves a concept called simple interest. Understanding how interest works is very important, and fortunately, a Simple Interest Calculator makes it simple for everyone.,This helpful online tool does the math for you instantly, and therefore, it helps you plan your finances wisely and avoid surprises.

Simple Interest Calculator Explains How Interest Works

First, let's understand what simple interest means. Basically, it is a way to calculate interest only on the original amount of money, called the principal. For example, if you borrow $1000 at a 5% annual interest rate for 3 years, you will pay interest only on that $1000 each year. this simple tool uses the formula: Interest = Principal × Rate × Time. You simply type in the loan or savings amount, the interest rate, and the time period. Then, the calculator gives you the total interest and the overall amount. Consequently, you see exactly how much you will earn or owe.

Simple Interest Calculator Helps in Many Real-Life Situations

Students often study interest in math class. By using This tool, they can check their homework answers, understand the formula, and therefore build a stronger foundation for more complex topics.

For Planning Savings Goals

Furthermore, if you are saving for a short-term goal, like a vacation, simple interest applies. A Simple Interest Calculator helps you see how much your money will grow, and as a result, you can set realistic targets.

Simple Interest Calculator Makes Finance Math Easy

So, how do you use this fantastic tool? It is designed to be very easy for everyone. First, you enter the principal amount. Next, you type in the annual interest rate and the time period in years, Then, you click the calculate button. The Simple Interest Calculator instantly provides the enterest amount and the total value, As a result, you get a clear picture of your finances without any confusion. In conclusion, understanding simple interest is a key part of managing money, and this tool on Tooltura is the perfect, free tool to help you. Try it today to take control of your financial decisions!

Frequently Asked Questions

Q1: What is a simple interest loan calculator and how does it work?

A: A simple tool is a digital tool that, first, requires the principal loan amount, interest rate, and loan term. Then, it multiplies these values together, and subsequently, it shows the total interest cost and the overall amount to be repaid.

Q2: Why should I use a simple interest savings calculator for my goals?

A: You should use this tool for goal planning because it projects your earnings; consequently, this helps you see how your money grows and, therefore, encourages consistent saving habits.

Q3: Can a simple interest rate calculator help compare different loan offers?

A: Absolutely, this tool is perfect for comparisons. You input the terms of each loan, and then it computes the total interest, which ultimately helps you identify the most affordable option.

(FAQs)

Q4: How does a simple interest formula calculator compute the interest?

A: This tool computes interest by first taking the principal amount. Then, it multiplies by the annual rate and time in years, and subsequently, it provides the interest without any compounding involved.

Q5: Is a free simple interest calculator accurate for financial decisions?

A: Yes, a reliable this tool is accurate for planning because it uses the standard simple enterest formula. However, for complex loans with fees, always consult your lender for precise details.

Q6: What are the benefits of using an online simple interest calculator?

A: The benefits of this tool are significant; specifically, it delivers instant results. As a result, you save time, avoid manual errors, and consequently, make informed financial choices quickly.

Q7: How do I calculate simple interest manually without a tool?

A: To calculate simple interest manually, you first multiply the principal by the annual interest rate. Then, you multiply that result by the time in years, and subsequently, you get the total interest amount, though this process can be slower than using a calculator.