Gratuity Calculator

Calculate the gratuity amount you’re entitled to receive with Gratuity Calculator

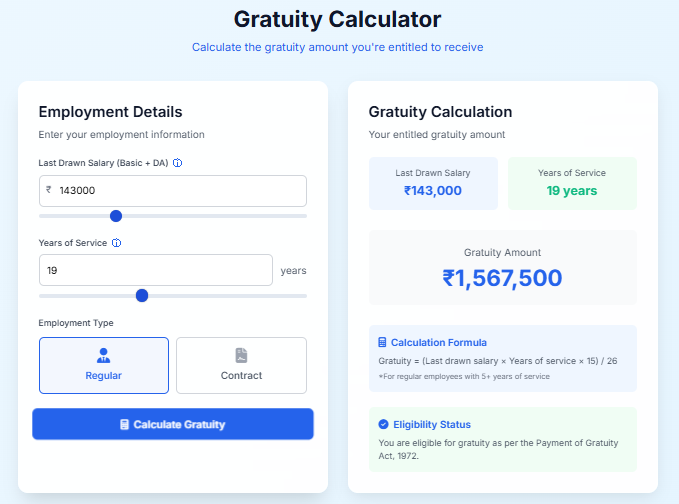

Employment Details

Enter your employment information

Regular

Contract

Gratuity Calculation

Your entitled gratuity amount

About Gratuity

What is Gratuity?

Gratuity is a lump sum amount paid by employers to employees as a token of gratitude for the services rendered by them during the period of employment.

Eligibility

- Minimum 5 years of continuous service

- Applies to factories, mines, oilfields, plantations, ports, railways, shops or other establishments

- Payable on superannuation, retirement, resignation, death, or disablement

Calculation Rules

For employees covered under the Payment of Gratuity Act:

- 15 days’ wages for each completed year of service

- Based on last drawn salary (basic + dearness allowance)

- Maximum gratuity amount is ₹20 lakhs

Important Notes

The information provided by this calculator is for illustrative purposes only. Actual gratuity amount may vary based on specific employment terms and conditions.

Gratuity Calculator : Your End-of-Service Reward Estimator

Gratuity Calculator is a tool that helps employees understand their end-of-service benefits, Have you ever wondered what happens financially when you leave a job after years of hard work?,Many companies reward long-serving employees with a special payment called gratuity, Figuring out how much you might receive can feel overwhelming with complex rules and formulas. Luckily, a Gratuity Calculator simplifies this process and provides clear estimates quickly!

First, it is important to know that gratuity is not just a gift; it is a financial reward for your dedication. Therefore, understanding how it is calculated empowers you to plan for the future. A Gratuity Calculator handles the tricky math based on your salary, years of service, and local laws, so you can focus on your career transition.

Gratuity Calculator : How It Works

So, how does a Gratuity Calculator compute your end-of-service pay? Actually, it is straightforward and requires only a few details from you.

- Enter Your Basic Salary: First, you input your monthly basic salary (excluding allowances).

- Input Years of Service: Next, you provide the total number of years you have worked for the company.

- Select applicable laws: Then, you choose the labor law relevant to your region (e.g., UAE, India, etc.).

- Click Calculate: After that, you press the “calculate” button.

Consequently, the tool processes these inputs using the legal formula. As a result, you receive an accurate estimate of your gratuity pay in seconds.

Gratuity Calculator : Why It’s a Vital Tool

This tool is incredibly useful for several key reasons. Mainly, it ensures transparency and helps you verify employer calculations, Additionally, it aids in financial planning for retirement or job changes. Moreover, it educates employees about their rightful benefits under the law.

For Employees and Employers

A Gratuity Calculator is essential for employees to advocate for fair compensation. It is also valuable for employers who aim to maintain compliance and build trust with their workforce.

Gratuity Calculator : Plan Your Financial Future

You should use a Gratuity Calculator when considering a job change or approaching retirement, It empowers you to make informed decisions and avoid surprises. Remember, knowing your entitlements is the first step toward financial security.

In conclusion, a gratuity calculator is a must-have tool for every working professional, Ultimately, it demystifies end-of-service benefits, promotes fairness, and supports smarter financial planning.

Gratuity Calculator: Frequently Asked Questions

Q1: How does a gratuity calculator for employees determine the final payout amount?

A1: for employees uses three key inputs: your last drawn basic salary, your total years of service, and the applicable gratuity formula per labor laws. First, it multiplies your salary by years served, then applies a legal multiplier (e.g., 21 days per year), and consequently, it generates an accurate estimate.

Q2: Can a UAE gratuity calculators account for different types of contract terminations?

A2: Yes, a UAE gratuity calculator distinguishes between resignation, termination, and retirement, For example, it adjusts the multiplier based on years served and termination reason, so you get a precise calculation tailored to your situation.

Q3: Why should I use an end-of-service benefit calculator before leaving my job?

A3: Using an end-of-service benefit calculator helps you plan finances and avoid surprises. First, it estimates your entitlement, then you can budget accordingly, and moreover, it ensures your employer’s calculation aligns with legal requirements.

(FAQs)

Q4: How accurate is a free online gratuity calculator for private sector employees?

A4: A free online gratuity calculator is highly accurate if updated with current labor laws. However, always cross-check with your HR department, as company policies or recent legal changes might slightly alter the final amount.

Q5: Does a gratuity calculator for limited contracts differ from unlimited contracts?

A5: Absolutely! A gratuity calculator for limited contracts often uses a different formula, such as full gratuiity after 5 years. Therefore, you must select your contract type initially, so the tool applies the correct rules.

Q6: Can I use a gratuity tax calculator to estimate deductions?

A6: Some advanced gratuity tax calculators estimate post-tax amounts, First, they compute the gross gratuity, then apply regional tax laws, and consequently, they show your net payout after deductions.

Q7: How do I calculate gratuity for incomplete years of service?

A7: A robust gratuity calculators prorates incomplete years, For instance, if you worked 5 years and 6 months, it calculates gratuity for 5 full years plus a proportional amount for the extra months, ensuring fairness.