Mortgage Calculator

Calculate your home loan EMI, taxes, insurance, and payment breakdown with Mortgage Calculator

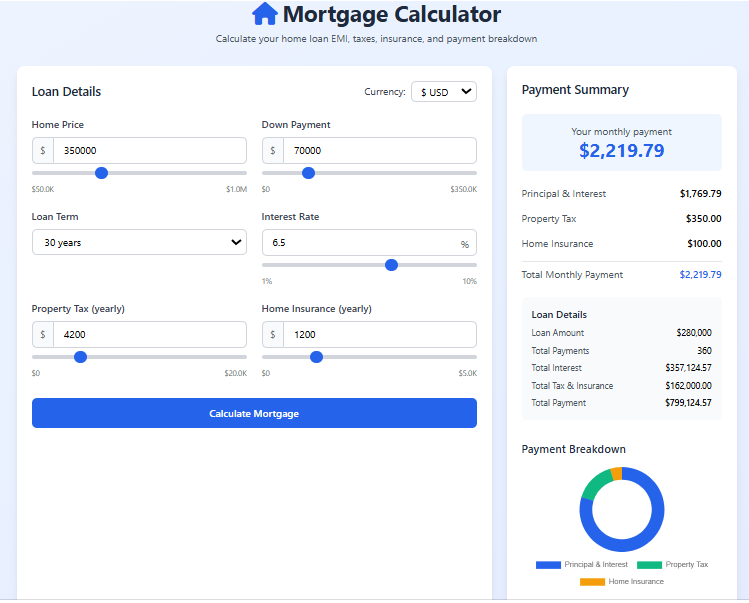

Loan Details

Payment Summary

Enter your loan details to calculate

Payment Breakdown

© 2023 Mortgage Calculator | Made with for home buyers

Mortgage Calculator: Your Guide to Understanding Home Costs

Have you ever dreamed of buying your own house but wondered how much it would cost each month? Figuring out a mortgage might seem complicated at first, but fortunately, a Mortgage Calculator makes it simple and clear. This helpful online tool shows you your estimated monthly payment instantly, and therefore, it helps you plan your budget wisely and confidently.

Mortgage Calculator Explains How Home Loans Work

First, let’s understand what makes up a mortgage payment. Basically, your monthly payment includes four parts: the loan principal, the interest, the property taxes, and the insurance. For example, if you borrow $200,000, you don’t just pay back that amount; you also pay extra called interest. A Mortgage Calculator adds all these costs together for you. You simply type in the home price, your down payment, and the interest rate, and then the calculator does all the hard math immediately. Consequently, you see a clear picture of your future expenses.

Mortgage Calculator Helps You Make Smart Choices

Moreover, this tool is not just for people buying their first home; it is useful for anyone considering a mortgage. A Mortgage Calculator helps you compare different options and avoid surprises.

For First-Time Home Buyers

If you are buying a home for the first time, you might feel unsure about what you can afford. By using a this Calculator, you can test different home prices and down payments, and therefore, you can find a comfortable payment that fits your budget.

For Planning an Refinance

Maybe you already have a mortgage but want to lower your payment. A Mortgage Calculator shows you how a new interest rate or loan term would change your monthly amount, and consequently, it helps you decide if refinancing is a good idea.

For Understanding Loan Terms

Furthermore, you can see how a 15-year loan compares to a 30-year loan. A Mortgage Calculator clearly shows the trade-offs: a shorter term means higher monthly payments but less interest paid overall, and as a result, you can choose what matters most to you.

Mortgage Calculator Makes Home Planning Easy

So, how do you use this fantastic tool? It is designed to be very easy for everyone. First, you enter the home price and your down payment amount. Next, you add the interest rate and the loan term. Then, you click the calculate button. The Mortgage Calculator instantly provides your estimated monthly payment, including taxes and insurance. As a result, you get a realistic view of homeownership costs without any confusion. In conclusion, understanding your mortgaage is a key step in buying a home, and the this tool on Tooltura is the perfect, free tool to help you. Try it today to plan for your future home

Frequently Asked Questions

Q1: What is a home mortgage calculator and how does it work?

A: A home mortgage calculator is an online tool that, first, allows you to input the loan amount, interest rate, and term. Then, it calculates the principal and interest, and subsequently, it provides an estimated monthly payment for your planning.

Q2: Why should I use a monthly mortgage payment calculator before house hunting?

A: You should use a monthly mortgage payment calculatoor before house hunting because it clearly shows what you can afford; consequently, this prevents you from looking at homes outside your budget and, therefore, saves you time and potential disappointment.

Q3: Can a refinance mortgage calculator show me if I should refinance my loan?

A: Yes, this tool can definitely help you decide. First, you input your current loan details and the new proposed terms; then, the calculator compares the payments and total interest, and ultimately, it shows your potential savings over time.

(FAQs)

Q4: How does a mortgage affordability calculators use my income to determine a budget?

A: A mortgages affordability callculator uses your gross income and existing debts to first determine your debt-to-income ratio. Then, it applies common lending guidelines to that ratio, and consequently, it provides a safe and realistic home price range for you.

Q5: Is a free mortgage calculator accurate for official loan estimates?

A: A high-quality calcu is very accurate for planning and comparison purposes because it uses standard mathematical formulas. However, for an official loan estimate, you must always consult a lender, as they include specific fees and your exact credit-based rate.

Q6: What is included in a FHA mortgage calculator that might be different?

A: An FHA mortgage calculator includes two unique things: the Upfront Mortgagge Insurance Premium (UFMIP) and the annual MIP premium. Consequently, these costs are added to the calculation, and therefore, they provide a more accurate estimate for government-backed loans.

Q7: How do I calculate mortgage payments with taxes and insurance included?

A: To calculate your full payment, you first need your principal and interest amount from a basic calculator. Then, you add your estimated annual property taxes and homeowners insurance (divided by 12), and subsequently, you arrive at your total monthly PITI payment.

Q8: Can a reverse mortgage calculator help me understand retirement income options?

A: Absolutely, a reverse mortgage callculator is designed for this purpose. You input your home value, age, and current mortgages balance; then, the calculator estimates available loan proceeds, and consequently, it helps you evaluate this option for retirement cash flow.