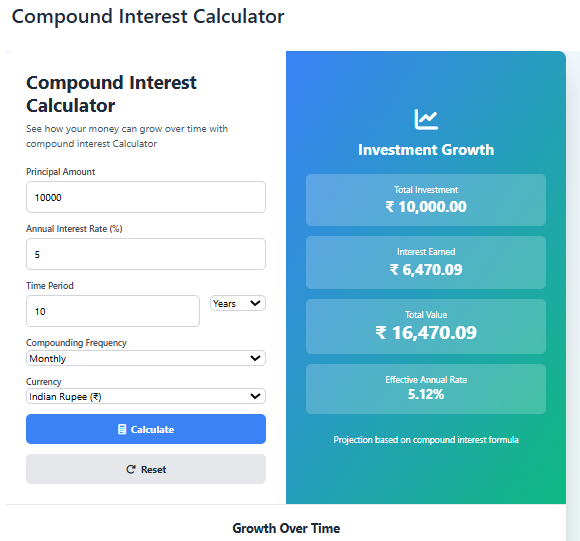

Compound Interest Calculator

See how your money can grow over time with compound interest Calculator

Investment Growth

Total Investment

–

Interest Earned

–

Total Value

–

Effective Annual Rate

–

Projection based on compound interest formula

Growth Over Time

Calculate to see chart

Compound Interest Calculator: The Magic Money Machine

Have you ever dreamed of a magic machine that multiplies your money while you sleep? Believe it or not, such a thing exists! It’s not a fantasy; it’s called a Compound Interest Calculator, This amazing tool shows you how your savings can grow incredibly over time,Essentially, you earn interest not only on your original money but also on the interest you’ve already earned. Consequently, your wealth starts to snowball, getting bigger and faster as the years go by.

Compound Interest Calculator: How It Works

Firstly, you need to understand the basics. For example, imagine you save $100. Then, you earn 5% interest each year,After the first year, you have $105, Importantly, the next year, you earn 5% on the new total of $105, not just your original $100. Therefore, you earn $5.25 in the second year. This process repeats year after year. As a result, your money grows exponentially, A Compound Interest Calculator does all this math for you instantly.

Compound Interest Calculators Inputs

To use this tool, you simply input a few key numbers, Specifically, you enter your starting amount, your monthly contribution, the annual interest rate, and the number of years you plan to save. After that, the calculator works its magic, It instantly shows you a detailed graph and a final total, You will be amazed at the future value of your consistent savings.

Results of Calculator

The results can be truly eye-opening. For instance, starting early is the biggest secret. A person who starts saving at age 20 will have much more money at retirement than someone who starts at age 40, even if they save the same amount monthly. This is because of the incredible power of time. Thus, the Calculator proves that time is your best friend in investing.

Why You Should Use a Compound Interest Calculator Today

Ultimately, this tool is essential for your financial future. It turns abstract numbers into a clear visual picture of your potential wealth, Moreover, it motivates you to start saving immediately. By seeing the dramatic results, you are encouraged to set financial goals, Therefore, find a free Compound Interest Calculator online and experiment with different numbers, You will quickly see how small, regular savings can transform into a large fortune. Start your journey to financial freedom now

For financial planning: “Understand your interest accrual by precisely calculating loan periods with our handy Days Calculator.”

Frequently Asked Questions: Compound Interest Calculator

Q1: How can I use a compound interest calculator to estimate my potential investment growth?

A: Firstly, a compound interest calculator is designed to project the future value of your investments or savings,To begin, you simply input your initial deposit, regular contribution amount, estimated annual interest rate, and time horizon. Subsequently, the algorithm calculates how your money grows, not only on your principal but also on the accumulated interest over time. Therefore, this provides a powerful visual of your potential investment growth, helping you set realistic financial goals.

Q2: What is the key difference between compound interest and simple interest, and why does it matter for long-term savings?

A: The primary difference is that simple interest is calculated solely on the initial principal amount, In contrast, compound interest is calculated on the principal amount plus any previously earned interest. Consequently, this “interest on interest” effect causes wealth to grow at an accelerating rate over time. This is precisely why understanding this difference is critical for long-term savings, as the compounding effect can significantly magnify your returns compared to simple interest.

Q3: How does the compounding frequency (monthly, quarterly, annually) impact the final calculation of my returns?

A: Generally, the compounding frequency dramatically impacts your final outcome. For example, interest that compounds monthly will generate returns faster than interest that compounds annually. This is because the interest is calculated and added to the principal more frequently, creating a larger base for the next calculation. As a result, when using a compound interest calculator, selecting a higher compounding frequency will typically show a higher final balance for the same interest rate and time period.

FAQs

Q4: Can a compound interest calculator help me plan for specific goals, like saving for a child’s education or retirement?

A: Absolutely In fact, this is one of the most powerful applications for this tool. For instance, you can work backwards by starting with your future financial goal (e.g., $100,000 for college) and then adjust the variables like monthly contribution and time horizon to see what it takes to get there, Ultimately, this makes a compound interest calculator an essential tool for building a tailored plan for major goals like saving for retirement or a child’s education fund.

Q5: What information do I need to get an accurate estimate from an online compound interest calculator?

A: To get started, you’ll need a few key pieces of information for an accurate calculation, Specifically, this includes your initial investment amount, the regular monthly or annual contributions you plan to make, the estimated annual interest rate you expect to earn, the number of years you plan to invest, and the compounding frequency. Having these details ready ensures you receive a reliable projection of your investment’s future value.