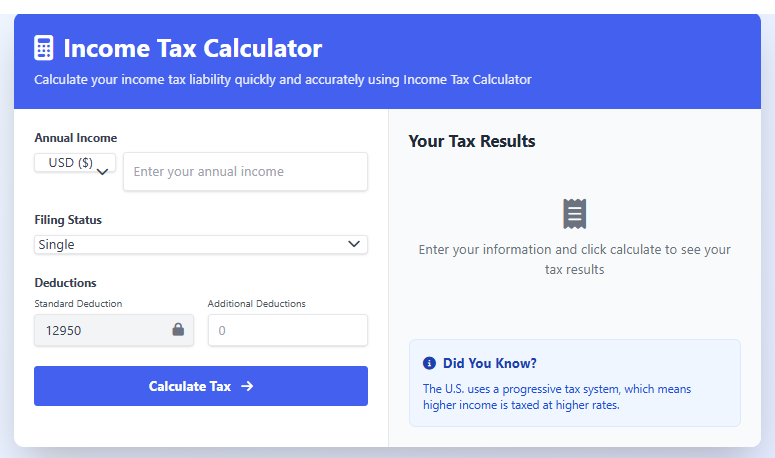

Income Tax Calculator

Calculate your income tax liability quickly and accurately using Income Tax Calculator

Your Tax Results

Enter your information and click calculate to see your tax results

Did You Know?

The U.S. uses a progressive tax system, which means higher income is taxed at higher rates.

2023 Tax Brackets (Single Filers)

| Rate | For Singles | For Married Jointly |

|---|---|---|

| 10% | Up to $11,000 | Up to $22,000 |

| 12% | $11,001 to $44,725 | $22,001 to $89,450 |

| 22% | $44,726 to $95,375 | $89,451 to $190,750 |

| 24% | $95,376 to $182,100 | $190,751 to $364,200 |

| 32% | $182,101 to $231,250 | $364,201 to $462,500 |

© 2023 Income Tax Calculator. This is for demonstration purposes only.

How to Use the Income Tax Calculator

Get your instant tax estimate now, and see your refund or tax owed in minutes with our Free Income Tax Calculator.”“First, enter your details, and then instantly discover how much you’ll owe or get back this year.”

Figuring out taxes can feel like a huge puzzle. Fortunately, an Income Tax Calculator is a fantastic tool that does the hard math for you, Essentially, this online helper gives you a close estimate of your tax bill or your tax refund, Therefore, you can stop guessing about your finances and start planning with confidence.

Income Tax Calculator: How it Actually Works

Firstly, you simply type in your financial information. For instance, you enter your total annual salary. Next, you include other details like your savings account interest. After that, you might subtract certain investments that save you tax. Subsequently, the calculator uses the latest government tax rules. Then, it instantly processes all your numbers. Finally, it shows you the final result: your estimated tax.

Income Tax Calculator and Your Salary

Your salary is the main ingredient. The Income Tax Calculators will first ask for your gross salary, Then, it often lets you subtract allowances like HRA (House Rent Allowance). This step is important because it lowers the amount of your income that is actually taxed.

Income Tax Calculator: Why You Should Use One Today

Using an This Calculator has many benefits. Primarily, it saves you a massive amount of time and stress, Instead of adding up numbers yourself, you get an answer in seconds. Moreover, it helps you avoid mistakes. Since it’s automated, the calculation is almost always accurate. Additionally, it is fantastic for planning your future. You can see how investing a little more now can save you money later.

Planning for Big Goals

Additionally, you can use it to plan for big life events. For instance, if you want to buy a house next year, you can see how a home loan will affect your taxes, This way, you make smarter financial decisions throughout the year, not just at the end.

How Your Salary Impacts Your Tax Calculation

First, your gross salary forms the foundational base of your entire tax calculation, Next, various exemptions and allowances, such as HRA or travel concessions, are subtracted from this amount. Consequently, this process significantly reduces your taxable income, thereby lowering your overall tax liability.

Frequently Asked Questions: Income Tax Calculator

Q1: How does an income tax calculator estimate my tax refund?

A: Our income tax calculator estimates your refund by taking your total income (wages, interest, etc.) and subtracting adjustments, deductions, and credits you specify, It then calculates your total tax liability based on current federal and state tax brackets. If the amount of tax you’ve already paid through withholdings is greater than your calculated liability, the difference is your estimated refund. It’s a powerful tool for planning your tax savings.

Q2: What information do I need to get an accurate calculation from a free income tax calculator?

A: For the most accurate estimate, have this information handy:

- Your filing status (e.g., Single, Married Filing Jointly)

- Your total annual income (W-2, 1099s)

- Approximate deductions (standard or itemized like mortgage interest)

- Number of dependents

- Contributions to retirement accounts (like a 401(k) or IRA)

- Any eligible tax credits (e.g., Child Tax Credit, EITC)

Having these details ready ensures you get a reliable accurate tax estimate for the year.

Q3: Can I use an online income tax calculator for self-employment taxes?

A: Yes, but you must use a calculator that includes a self-employment section. Our calculator allows you to input your 1099 income and business expenses. It will then calculate your income tax and your self-employment tax (Social Security and Medicare), giving you a complete picture of your tax liability for freelancers and independent contractors.

FAQs

Q4: How often are the tax tables and rules in the calculator updated?

A: Our income tax calculator is updated immediately following any official announcement from the IRS or state tax authorities regarding new tax brackets, standard deduction amounts, or tax laws, You can trust that it always uses the latest information to provide a current year tax projection based on new tax rules.

Q5: Why is the estimated tax amount from this calculator different from my tax software?

A: Small differences can occur for a few reasons. Our calculator provides a high-level estimate based on the information you provide, while dedicated tax software dives deeper into complex forms and niche situations. The discrepancy might be due to:

- Missing specific tax forms or credits in our simplified input.

- Differences in how state taxes are handled.

- Updates in tax law that one platform has implemented faster.

For a final figure, always consult a qualified tax professional or full-service software, Our tool is best for planning and estimating tax owed before filing.

Q6: Is my financial data secure when I use your online tax calculator?

A: Absolutely. We take data security seriously. Our income tax calculator runs on a secure, encrypted connection (HTTPS) We do not store any of the personal financial information you enter into the calculator on our servers, Your data is only processed in real-time to generate your estimate and is then discarded, ensuring complete privacy for your secure online tax calculation.