Loan to Value Ratio Calculator

Loan to Value Ratio Calculator

Loan to Value Ratio Calculator is a financial term used by lenders to express the ratio of a loan to the value of an asset purchased. It’s a key risk assessment factor for lenders—the higher the LTV, the higher the risk for the lender.

How to use:

- Enter the loan amount you’re requesting

- Enter the appraised value or purchase price of the asset

- See your LTV ratio and risk assessment instantly

- Use the sliders to explore different scenarios

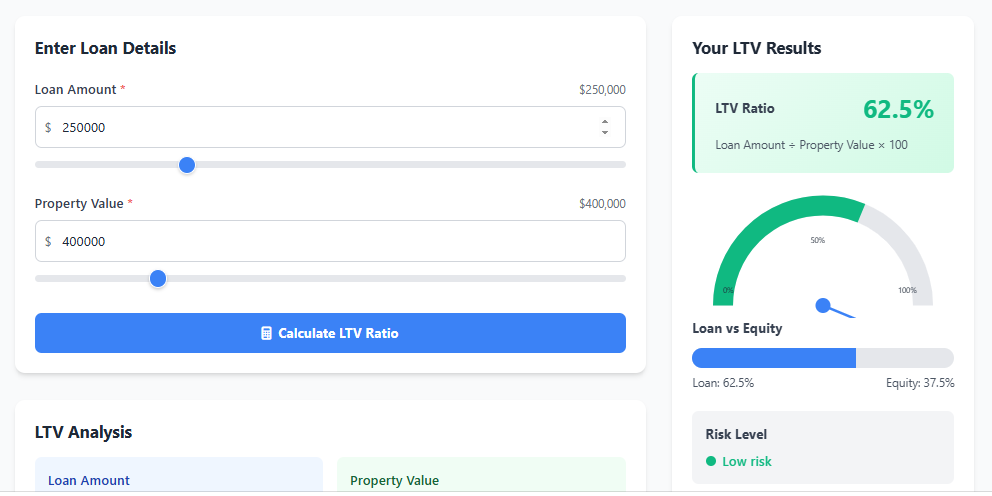

Enter Loan Details

LTV Analysis

Loan Amount

$250,000

Property Value

$400,000

Risk Assessment

Based on your LTV ratio of 62.5%, you’re in a low risk category. This generally means better loan terms and lower interest rates.

What LTV Means for You

Lower than 80%: Generally considered low risk. You may qualify for better interest rates and avoid private mortgage insurance (PMI).

80% to 95%: Moderate risk. You may need to pay for PMI or have slightly higher interest rates.

Above 95%: High risk. You may face higher interest rates, stricter requirements, or difficulty qualifying for loans.

Your LTV Results

LTV Ratio

Loan vs Equity

Risk Level

Understanding Loan-to-Value Ratio

What is LTV?

The Loan-to-Value (LTV) ratio is a financial term used by lenders to express the ratio of a loan to the value of an asset purchased. It’s calculated by dividing the loan amount by the appraised value of the property.

Why LTV Matters

Lenders use LTV to assess risk. A higher LTV ratio indicates more risk for the lender, which may result in higher interest rates, requirement for mortgage insurance, or even loan denial.

How to Improve Your LTV

You can improve your LTV ratio by making a larger down payment, paying down your mortgage balance, or through property value appreciation.

LTV in Refinancing

When refinancing, lenders typically require an LTV ratio of 80% or less to avoid PMI. Some loan programs allow higher LTV ratios but may have stricter requirements.

Loan to Value Ratio Calculator: Your Key to Smart Borrowing

Have you ever wondered how banks decide to approve a loan for a house or a car? They use a special number called the Loan-to-Value ratio, or LTV. Understanding this number is very important, and fortunately, a Loan to Value Ratio Calculator makes it simple for everyone. This powerful tool helps you see your borrowing power clearly, and therefore, you can make smarter financial choices with confidence.

Loan to Value Ratio Calculator Explains the LTV Number

First, let’s understand what LTV means. Basically, it is a comparison between the amount of money you want to borrow and the value of the item you are buying. For example, if you want a $80,000 loan for a $100,000 house, your LTV ratio would be 80%. A Loan to Value Ratio Calculator does this math for you instantly. You simply type in the loan amount and the property value, and then the calculator gives you the exact LTV percentage immediately. Consequently, you instantly understand your financial position.

Loan to Value Ratio Calculator Helps You in Many Ways

Moreover, this tool is not just for bankers; it is incredibly useful for anyone thinking about borrowing money. A Loan to Value Ratio Calculator helps you plan better and avoid big mistakes.

For Getting Mortgage Approval

If you want to buy a house, banks prefer a lower LTV ratio. By using a Loan to Value Ratio Calculator first, you can see if you need a bigger down payment, and therefore, you can improve your chances of loan approval.

For Avoiding Lender’s Mortgage Insurance

Sometimes, if your LTV ratio is too high, the bank will ask you to pay for insurance. Consequently, using the calculator helps you understand this cost ahead of time, and ultimately, it helps you save money.

Loan to Value Ratio Calculator Makes Math Easy

So, how do you use this fantastic tool? It is designed to be very easy. First, you find the value of the property or vehicle. Next, you type in the amount of money you want to borrow. Then, you press the calculate button. The Loan to Value Ratio Calculator does the division for you and shows your LTV ratio right away. As a result, you get a clear picture of your loan situation without any hard math. In conclusion, understanding your LTV ratio is a key part of borrowing money wisely, and the Loan to Values Ratio Calculator on Tooltura is the perfect, free tool to help you. Try it today to plan your next big purchase like a pro

Loan to Value Ratio Calculator Frequently Asked Questions

Q1: What is an LTV loan calculator and how does it work?

A: An LTV loan calculator is a digital tool that, first, requires you to input the loan amount you are seeking. Then, you enter the appraised values of the asset, and subsequently, the this tool instantly divides the loan by the value to provide your LTV ratio as a percentage.

Q2: Why should I use a mortgage loan to value calculator before home shopping?

A: You should use a mortgage loan to value calculator before home shopping because it clearly shows how much down payment you will need; consequently, this helps you set a realistic budget and, therefore, strengthens your position when making an offer.

Q3: Can a commercial loan to value ratio calculator be used for investment properties?

A: Yes, a commercial loan to value ratio calculatoor is perfectly suited for investment properties because it follows the same core principle: it compares the loane amount to the property’s value to assess risk and, ultimately, to determine your equity stake.

(FAQs)

Q4: How does a auto loan LTV calculator help with car financing?

A: An auto loan LTV calculator helps with car financing significantly; first, it shows if you might need a down payment to lower your ratio, and then, it helps you avoid being “upside down” on your loan (owing more than the car’s value) later on.

Q5: Is a free loan to value ratio calculator accurate for official purposes?

A: A high-quality free loan to value ratio calculator is extremely accurate for planning and educational purposes because it uses a standard mathematical formula. However, for an official loan application, you must always use the lender’s final appraised value for the most precise figure.

Q6: What is a good LTV ratio for a mortgage according to a calculator?

A: According to most guidelines, a good LTV ratio for a mortgage is typically 80% or lower. Firstly, this ratio often allows you to avoid private mortgage insurance (PMI), and as a result, it can save you a significant amount of money over the life of your loan.

Q7: How do I calculate loan to value ratio manually if needed?

A: To calculate your loan-to-value ratio manually, you first take the loan amount and then divide it by the appraised property value. Next, you multiply that result by 100 to get a percentage, and consequently, you will have your final LTV ratio figure.

Q8: Can I use a heloc loan to value calculator for a home equity line of credit?

A: Absolutely, a heloc loan to value calculator is specifically designed for this. You input your first mortgage balance and the home’s current value, and then the calculator shows you how much equity you might be able to borrow against for your line of credit.