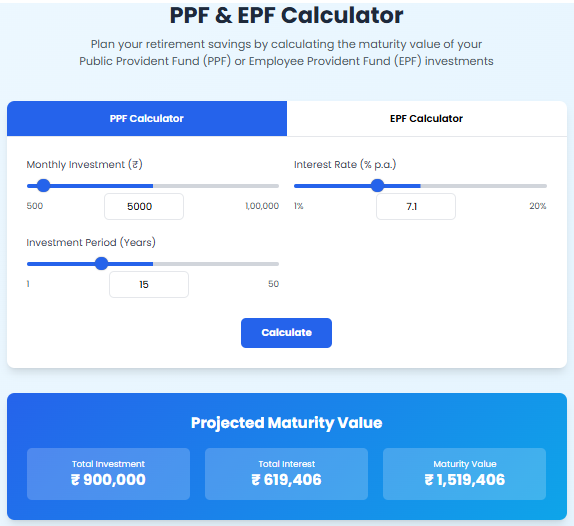

PPF & EPF Calculator

Plan your retirement savings by calculating the maturity value of your Public Provident Fund (PPF) or Employee Provident Fund (EPF) investments using PPF & EPF Calculator

Projected Maturity Value

Total Investment

₹ 0

Total Interest

₹ 0

Maturity Value

₹ 0

About PPF

- Minimum investment: ₹ 500 per year

- Maximum investment: ₹ 1.5 lakh per year

- Lock-in period: 15 years

- Tax-free returns under Section 80C

About EPF

- Employee contributes 12% of basic salary + DA

- Employer contributes 3.67% to EPF and 8.33% to EPS

- Withdrawal allowed after retirement or unemployment

- Tax benefits under Section 80C

PPF & EPF Calculator: Your Guide to Retirement Planning

Have you ever wondered how much money you will have when you retire? Planning for the future is very important, and fortunately, a PPF & EPF Calculator makes it simple and clear. This helpful online tool shows you how your savings can grow over time, and therefore, it helps you make smart decisions for a secure future.

PPF & EPF Calculator Explains How Your Money Grows

First, let's understand what PPF and EPF are. Basically, PPF (Public Provident Fund) and EPF (Employee Provident Fund) are savings plans that help you save money for retirement. For example, when you put money into these funds, it earns interest every year. A PPF & EPF Calculator uses math to predict your future savings. You simply type in how much you save each month, the interest rate, and the number of years you will save. Then, the calculator shows you the total amount you will have later. Consequently, you can see how your small savings become a large amount over time.

PPF & EPF Calculator Helps You Plan Your Future

Moreover, this tool is not just for adults with jobs; it is useful for anyone who wants to save money. A PPF & EPF Calculator helps you set goals and stay motivated.

For Young People Starting to Save

If you are just beginning to save, you might not know how much to put aside. By using a PPF & EPF Calculator, you can try different amounts and see how they grow, and therefore, you can choose a plan that fits your budget.

For Planning Retirement

Everyone dreams of a comfortable retirement. A PPF & EPF Calculator shows you how much you need to save each month to reach your goal, and consequently, it helps you stay on track.

For Understanding Interest Benefits

Furthermore, these funds earn compound interest, which means you earn interest on your interest. A PPF & EPF Calculator shows you how powerful compound interest is, and as a result, you understand why starting early is so important.

PPF & EPF Calculator Makes Saving Easy

So, how do you use this fantastic tool? It is designed to be very easy for everyone. First, you enter how much you can save regularly. Next, you add the interest rate and the number of years you will save. Then, you click the calculate button. The PPF & EPF Calculator instantly shows your future savings and the interest you will earn. As a result, you get a clear picture of your financial future without any confusion. In conclusion, planning for retirement is a key part of life, and the PPF & EPF Calculator on Tooltura is the perfect, free tool to help you. Try it today to start building your future!

Frequently Asked Questions

Q1: What is a PPF maturity calculator and how does it work?

A: A PPF maturity calculator is an online tool that, first, requires your annual investment amount and tenure. Then, it applies the current interest rate with compounding, and subsequently, it provides the final maturity amount you will receive.

Q2: Why should I use an EPF pension calculator before retirement?

A: You should use an EPF pension calculator before retirement because it estimates your monthly income; consequently, this helps you plan your post-retirement expenses and, therefore, ensures a comfortable life without financial stress.

Q3: Can a PPF interest calculator show me how compounding works?

A: Absolutely, a PPF interest calculator is perfect for understanding compounding. It breaks down how your interest earns more interest each year, and then it shows the power of long-term savings, which ultimately encourages you to start early.

(FAQs)

Q4: How does an EPF balance calculator use my salary to estimate savings?

A: An EPF balance calculator uses your basic salary and dearness allowance to first determine your monthly contribution. Then, it projects the growth with interest over your working years, and subsequently, it estimates your total balance at retirement.

Q5: Is a free PPF EPF calculator accurate for financial planning?

A: Yes, a reliable free PPF EPF calculator is very accurate for planning because it uses the official interest rates and compounding formulas. However, you should consult a financial advisor for a detailed retirement plan tailored to your needs.

Q6: What are the benefits of using a retirement provident fund calculator?

A: The benefits of a retirement provident fund calculator are significant; specifically, it gives a clear picture of your future savings. As a result, you can set realistic goals, adjust your contributions, and consequently, build a sufficient retirement corpus.

Q7: How do I calculate my EPF amount without a tool?

A: To calculate your EPF amount manually, you first determine your monthly contribution (12% of salary). Then, you estimate the annual interest compounded monthly, and subsequently, you project the total over your employment years, though this process is complex and time-consuming.